trust capital gains tax rate 2022

Capital Gains Tax Rate 2022. The measure will bring around 25000 individuals into the scope of Capital Gains Tax.

Trusts and estates are taxed at 28 in these circumstances.

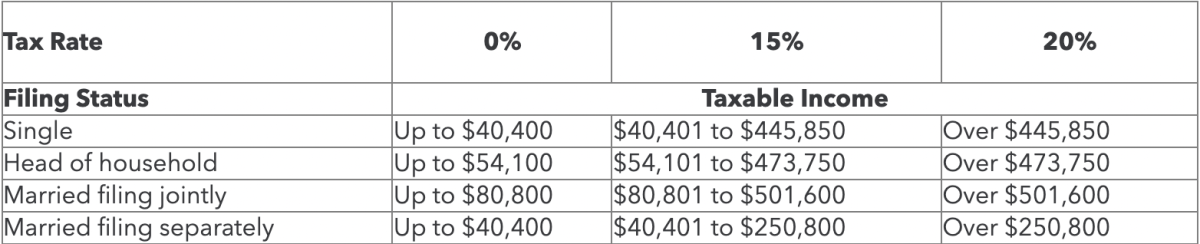

. Explore updated credits deductions and exemptions including the standard deduction. Capital gains tax rate 2022. The taxable income thresholds for the capital gains tax rates are adjusted each year for inflation.

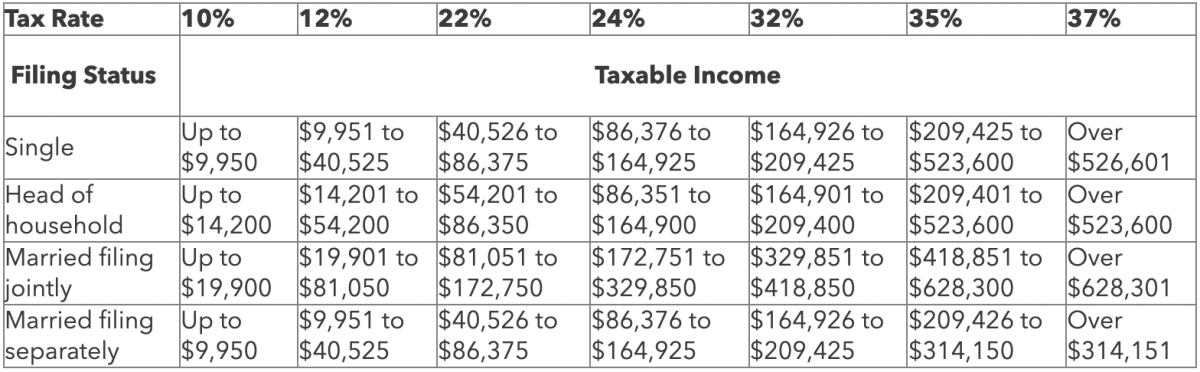

The IRS has already released the 2022 thresholds see table below so you. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. At basically 13000 in income they hit the highest tax rate.

Tax rates on capital gains are set for 2021-22 and 2020-21. Capital Gains And Qualified Dividends. Capital Gains Tax Would Be Increased To 288 Percent By House Democrats.

2022 Capital Gains Tax Rate Thresholds Tax on Net Investment Income Theres an additional 38 surtax on net investment income NII that you might have to pay on top of the. The IRS recently released the new inflation adjusted 2022 tax brackets and rates. Capital Gains Rates 2022 Trusts Capital Gains Tax Rate 2022 It is widely accepted that capital gains are gains generated by the sale.

Capital gains tax would be raised to 288 percent. 2022 Capital Gains Tax For Trusts. Events that trigger a disposal include a sale donation exchange loss.

Capital Gains Tax Rate 2022. Instead of the annual. Capital gains tax is expected to be increased to 288.

Capital gains tax is expected to be increased to 288. The effective rate of CGT is the range of 72 to 18 for individuals 224 reducing to 216 for tax years commencing 1 April 2022 for companies and 36 for Trusts although correctly. Irrevocable trusts have a major tax issue.

The 0 and 15 rates continue to apply. 2022 Long-Term Capital Gains Trust Tax Rates. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

Capital Gains Tax Rates 2022. 5 rows Capital Gains Tax Rate 2022. 10 percent 12 percent.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Weve got all the 2021 and 2022 capital gains.

This means you can make a gain of 12300 before any CGT is payable. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. 5 rows The proposal by House Democrats would also add a 3 percent tax on persons with modified adjusted.

2021 Long-Term Capital Gains Trust Tax Rates Tax documents Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2020 to 2021 tax year.

Although irrevocable trusts are complex trusts which means they can. It continues to be important to obtain. February 6 2022 by Brian A.

That means you could pay up to 37 income tax depending on your federal income tax bracket. For tax year 2022 the 20 rate applies to amounts above 13700.

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

San Diego Capital Gains Tax On A Second Home In 2022 Capital Gains Tax Capital Gain San Diego

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

/images/2021/05/05/happy-young-investor.jpg)

How To Avoid Capital Gains Tax On Stocks 7 Tricks You Need To Know Financebuzz

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Tax Advantages For Donor Advised Funds Nptrust

Like Kind Exchanges Of Real Property New Final Regs In 2022 Grantor Trust Types Of Planning Tax Advisor

Capital Gains Tax What Is It When Do You Pay It

Pin By Larry Oliver Reed On Investing Investing Income Tax Brackets Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

Capital Gains Tax What Is It When Do You Pay It

Like Kind Exchanges Of Real Property New Final Regs In 2022 Grantor Trust Types Of Planning Revocable Trust